The Bureau of Economic Analysis (BEA) recently released its annual report on personal income growth and prices at the state level. The good news is that personal income in Missouri in 2013, the most recent year for which data are available, increased faster than the national average. Unfortunately, a substantial portion of that increase was eaten up by rising prices. Adjusted for inflation, personal income in Missouri increased slower than the national average.

Can’t we just enjoy the fact that income rose? Increases in income unadjusted for price changes—what economists call nominal income—can give a false signal of prosperity. Think of it this way: If your wage doubles, are you better off? If the prices of things you buy haven’t changed, then, yes, you are. But if the prices of goods and services also doubled, your higher wage buys no more than it did before your raise. So we really should compare changes in real personal income—the equivalent to your wage relative to what it can buy—to see if we actually are better off.

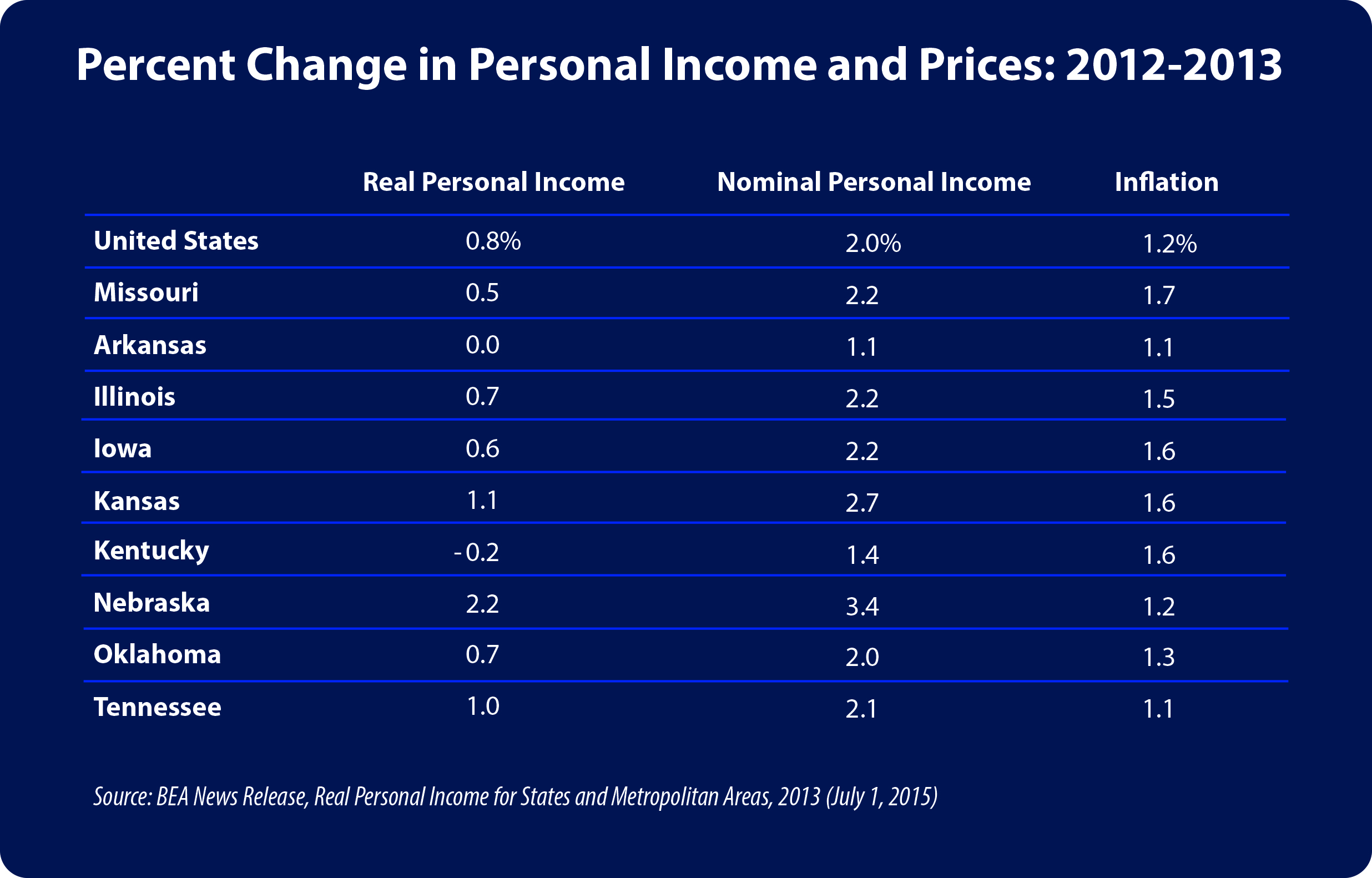

The table below reports the 2013 growth rates in real personal income, nominal income, and inflation for the United States, Missouri, and its neighboring states. The percentage change in real income is equal to the difference between nominal income and the rate of inflation. How did Missouri fare when comparing growth in real personal income?

Real personal income in Missouri increased at a 0.5 percent rate in 2013. This reflects the fact that even though nominal income increased at a healthy 2.2 percent rate, prices increased at a 1.7 percent rate. Though Missouri’s nominal income growth exceeded the national average (2.2 vs. 2.0 percent), the fact that the rate of inflation in Missouri was higher than the U.S. average (1.7 vs. 1.2 percent) explains why real personal income in Missouri rose slower than the national average (0.8 percent). This combination of income growth and inflation also explains why Missouri’s increase in real personal income was slower than in four neighboring states, about as fast as in two, and exceeded that for two others. Among the neighboring states, Nebraska was the clear winner, with Kentucky trailing the pack.

The story from the latest data is that while Missouri’s economy continues to grow, the pace of improvement lags the national average and many of its neighbors.