Researchers and activists across Missouri have long decried the way in which city governments too easily give away taxpayer money. One particularly odious handout is tax-increment-financing (TIF), which allows city leaders to give away money that belongs to other taxing jurisdictions such as schools and libraries.

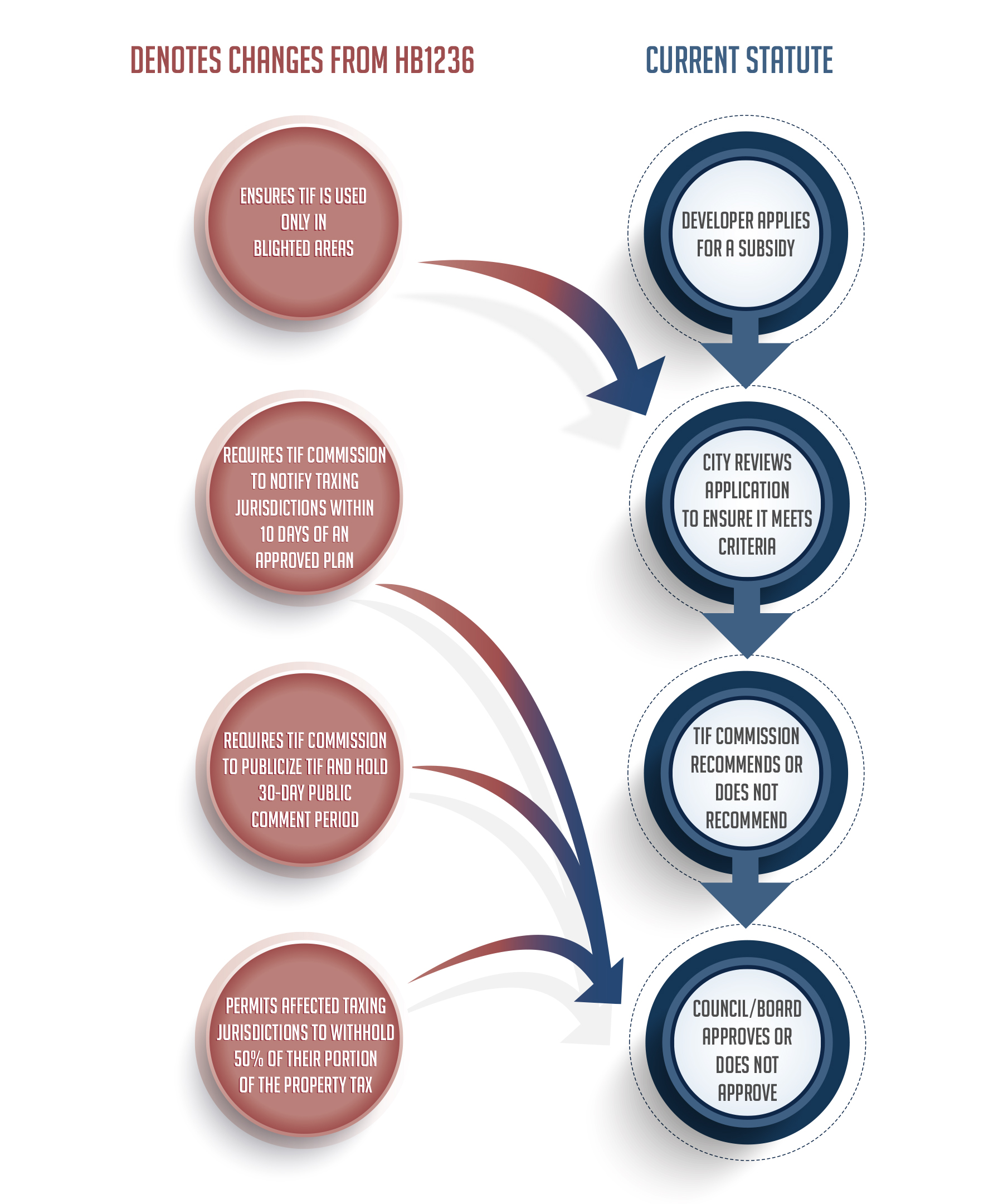

Happily, legislators are considering a reform proposal that would make three important changes to how TIF projects are awarded.

- It would eliminate TIF for the use of anything other than combating blight, eliminating TIF for “conservation areas,” and “economic development areas,” ensuring that it is used in “redevelopment areas” only inasmuch as they are blighted. Regarding blight, it removes from the blight definition such considerations as “defective or inadequate street layout,” “deterioration of site improvements, improper subdivision or obsolete platting” and “morals.” We’ve suggested a completely new standard for blight, but the language in the proposal is a step in the right direction.

- Once a TIF plan is sent to a city government for final approval, that body must hold a 30-day comment period before it votes on the proposed district.

- Finally, and perhaps most importantly, it grants those taxing jurisdictions a 60-day period after the city council or board of aldermen approves the TIF plan to decide on whether to withhold half of their portion of the TIF taxes excluded.

Proponents of TIF have argued that school districts have no incentive to give up their property tax and with vote to exclude themselves every time. But that argument does not stand up under examination. Missouri school districts have voted to support TIF in the past when it made sense. And in Kansas, where school superintendents may withhold all of their tax funds, they rarely if ever do.

The most powerful parts of this bill are the 30-day comment period and the ability of the taxing jurisdictions to exclude half their taxes. These provisions mean more time to consider the impacts of TIF plans and give more influence over the process to those with the most to lose.

Some will undoubtedly claim that this reform will kill TIF, but that’s unlikely. What it will do it make it more likely that TIF projects are a good deal for everyone, including developers, cities, libraries, and school districts. Taxpayers will need to remain vigilant, and this bill gives them more time to comment. Who could be against that?