Taxes. They’re high. They’re regressive. They’re inefficient. And in Missouri there are too many of them.

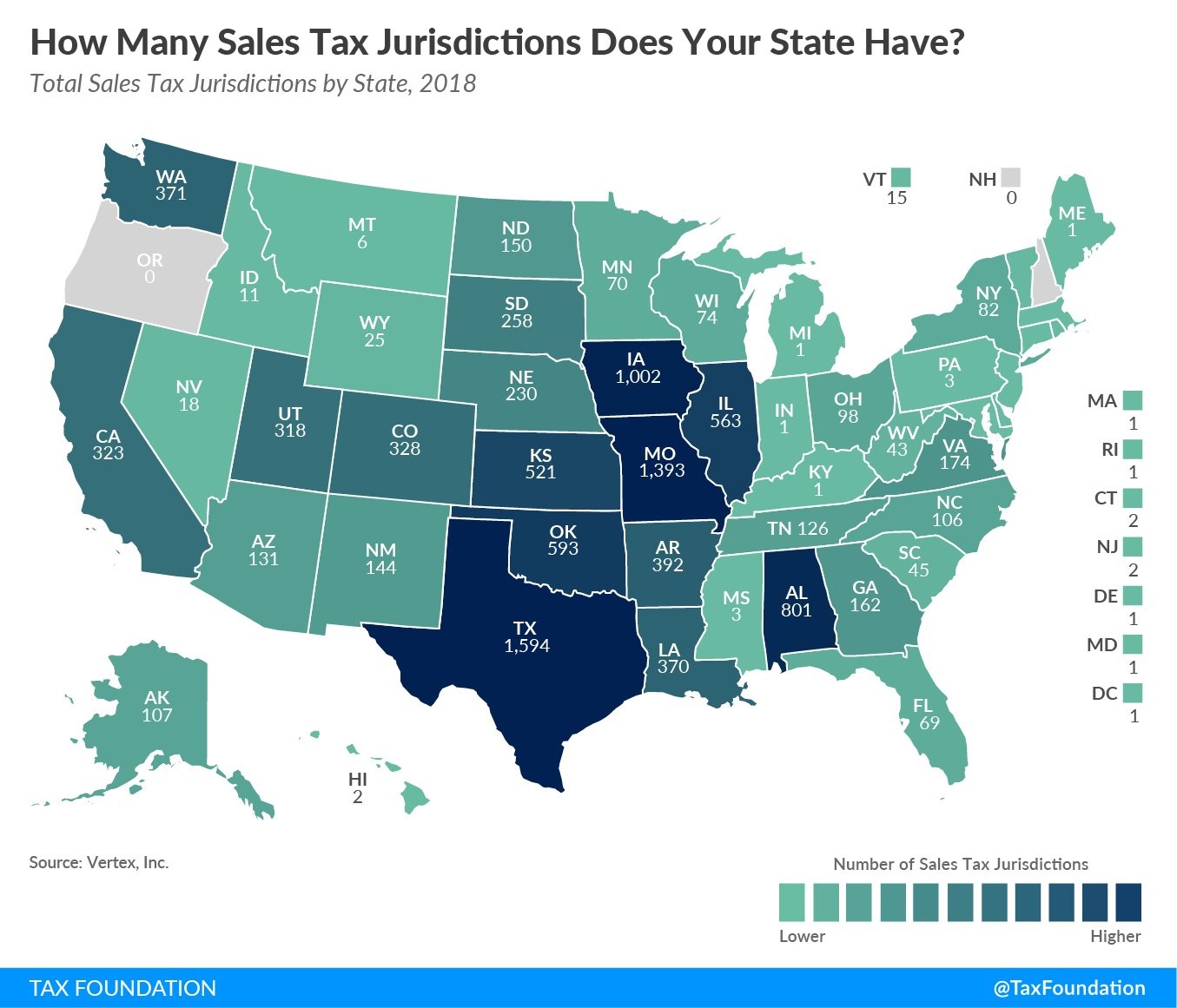

None of this is to say that taxes are unnecessary or even bad. Taxes are necessary to fund the basic services we all agree are the responsibility of government. But Missouri can do better. A report from the Tax Foundation released last week underscores the point. According to the Tax Foundation’s count, Missouri has 1,393 sales tax jurisdictions, second only to Texas.

This staggering number is due to special taxing districts such as community improvement districts, transportation development districts, and the like. These districts are easily established and are often not open and transparent. Many were established without a public vote. Yet each has the power to tax us on each purchase.

One effort to cap the sales tax rate in Missouri at 14 percent is making its way through the legislature. But if the proliferation of special taxing districts itself is not addressed, the general assembly risks ceding its influence over tax policy to an ever-growing number of tiny fiefdoms.