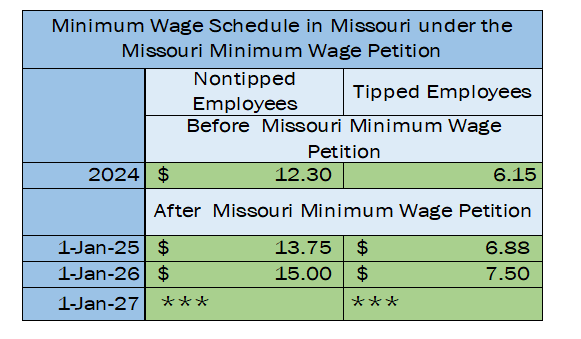

Who wouldn’t want to get a pay raise? Everyone would enjoy higher wages—but what if a raise meant fewer hours or even unemployment? Missouri voters will likely decide on an increase in the minimum wage that will phase in from $12.30 to $15.00 per hour by 2026. If the ballot measure is passed, the minimum wage will increase by $1.45 to $13.75 on January 1, 2025, and by $1.25 to $15.00 on January 1, 2026. While raising the minimum wage may seem beneficial for low-income workers, once businesses fully adjust to the minimum wage increase, low-income and low-skilled workers are likely to be worse off.

Similar to Missouri’s potential $15.00 minimum wage, Seattle’s minimum wage ordinance passed in 2014 phased in an increasing minimum wage in the City of Seattle from the state’s $9.47 minimum to $11 in 2014, $13 in 2016, and $15 in 2017. A 2017 study at the University of Washington found that the increase to $15 an hour resulted in low-skilled workers experiencing a reduction in hours worked or even job loss. This decrease in hours worked for low-skilled workers resulted in “a net loss of $74 per month.” A pay cut of $74 per month can have a significant impact on low-income workers. The study found that employers opted to replace low-skilled workers with higher-skilled workers who could perform the job more effectively and therefore warrant a wage equivalent to the new minimum wage.

Seattle’s experiences are just one example of how a minimum wage increase negatively affects low-income workers. California recently increased its minimum wage to $20 for fast-food workers, resulting in many workers suffering from a loss of income. Mark Harmsworth, director of the Small Business Center at the Washington Policy Center, said:

Sometimes, instead of a salary bump, many workers instead find their work hours cut or their jobs eliminated completely. For some employees, if they fall below a minimum hour threshold required for benefits, they lose benefits too.

Increasing the minimum wage is a misguided way to try and help workers. If policymakers and voters want to assist low-income workers, then increasing the Earned Income Tax Credit would be a better approach.