- This event has passed.

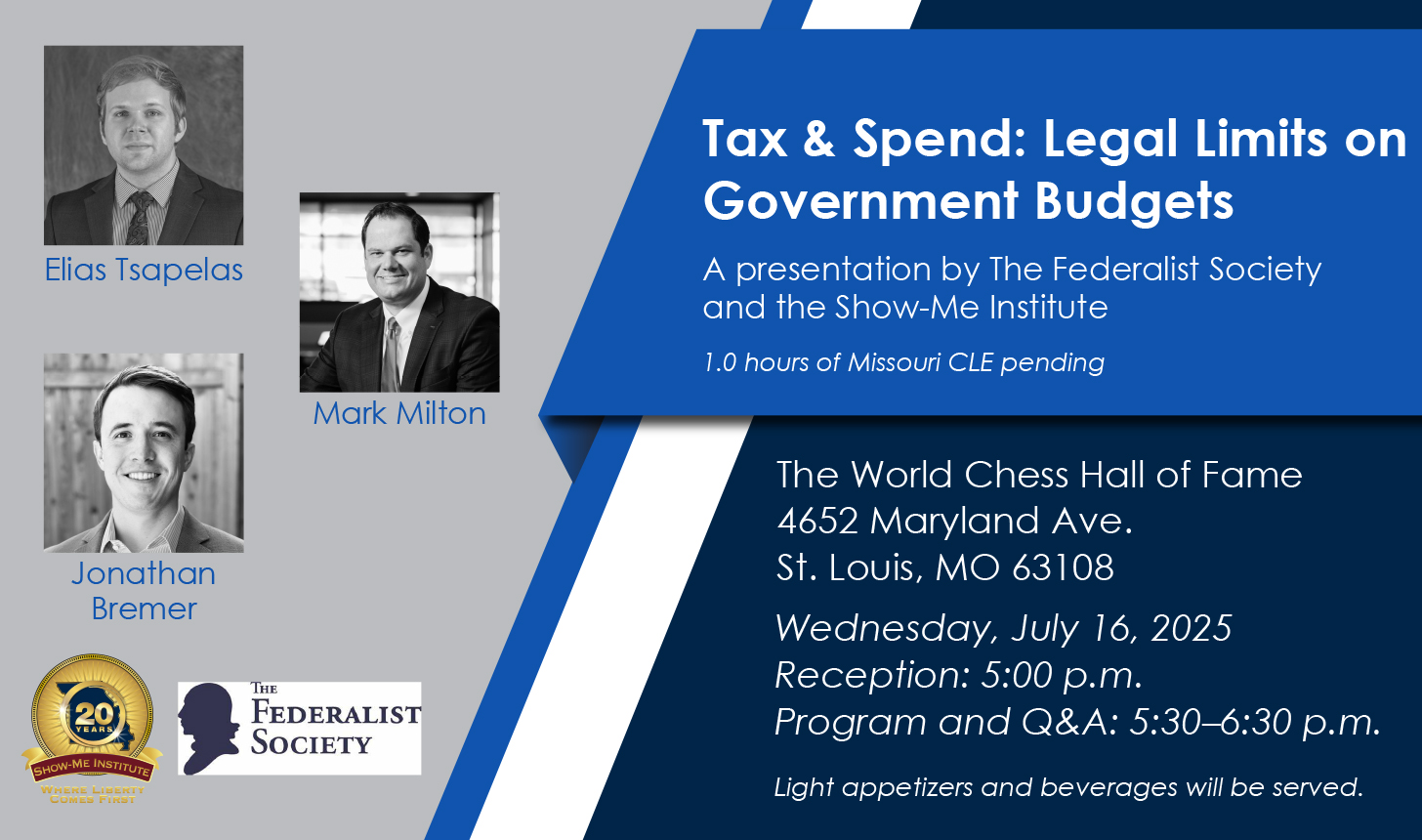

Tax and Spend: Legal Limits on Government Budgets

July 16 @ 5:00 pm - 6:30 pm

Do state balanced budget requirements (i.e., tax and expenditure limitations) effectively constrain government spending? How can tax policy promote efficient collection and use of taxpayer dollars?

These questions and more will be explored with special attention to Missouri and the City of St. Louis. Topics will include Missouri’s Hancock Amendment along with the City of St. Louis’s fiscal woes and its notorious 1% earnings tax, among other things.

Spots are limited! Don’t miss this opportunity to learn about tax policy AND earn CLE credit!

Registration Begins June 30, 2025.

Register Here

Note: If this event is marked as “Sold Out,” those wishing to attend should email [email protected] to inquire about available seats.